Investment Thesis (In One Sentence)

Water Garden Farms combines proven AI-driven agriculture, institutional-grade automation, contracted demand, and FlarePoint’s net-carbon-zero energy infrastructure to deliver infrastructure-like cash flows with private-equity-level returns.

WHAT IS THE ROI?

This is calculated by dividing the net distributions (EBITA minus debt payments) to the partners by their investment, whether a Letter of Credit, Project-Related Asset, or Hypothecated Bitcoin. It does not include asset value after 5 years.

WHAT IS THE IRR?

WHAT IS THE YIELD?

WHAT IS THE UVP?

1. A.I. Driven Farming

2. Off-grid 0-net-carbon power plant

3. Hyper-scaling product consumption

4. Potential Carbon Credit production

HOW IS THE RISK MITIGATED

2. Strong, Predictable Cash Flows: The project is supported by AI-driven, fully automated operations with proven commercial production, generating high-margin, infrastructure-like cash flow.

3. Energy Independence & Cost Control: FlarePoint’s off-grid CHP micro-grid lowers power costs by over 50%, eliminates grid volatility, removes boiler and purchased CO₂ expenses, and stabilizes operating margins.

4. Institutional-Grade Automation: Siemens-powered automation and AI controls reduce labor risk, yield variability, contamination risk, and operational downtime.

5. Demand Validation & Off-Take Support: Established relationships with major national retailers and food distributors reduce market and pricing risk.

6. Conservative Capital Stack: A well-subordinated equity position beneath senior project debt, combined with strong DSCR, enhances lender confidence and protects equity value.

7. ESG & Regulatory Alignment: Net-zero energy design, USDA organic production, and materially lower water and land use improve long-term regulatory resilience and exit optionality.

FlarePoint Value-Add:

CHP + 0-Net-Carbon Micro-Grid

FlarePoint Capital Partners has materially enhanced the project economics by integrating a 2.5 MW off-grid combined heat & power (CHP) natural-gas micro-plant with carbon capture.

Key Benefits:

- Self-sufficient green energy (no grid dependence)

- Electricity cost reduced from ~10¢/kWh to ~4.25¢/kWh

- Heat recapture eliminates the need for separate boilers

- Captured CO₂ reused for plant enrichment, eliminating purchased carbon inputs

- Net-zero carbon profile through carbon capture

- ≈$10 million reduction in operating expenses over the first 5 years

- Additional carbon credit revenues not included in base projections

This energy integration:

- Improves EBITDA and DSCR

- Reduces lender risk

- Eliminates grid volatility

- Enhances ESG credentials

- Strengthens long-term cash-flow predictability

“Water Garden Farms”

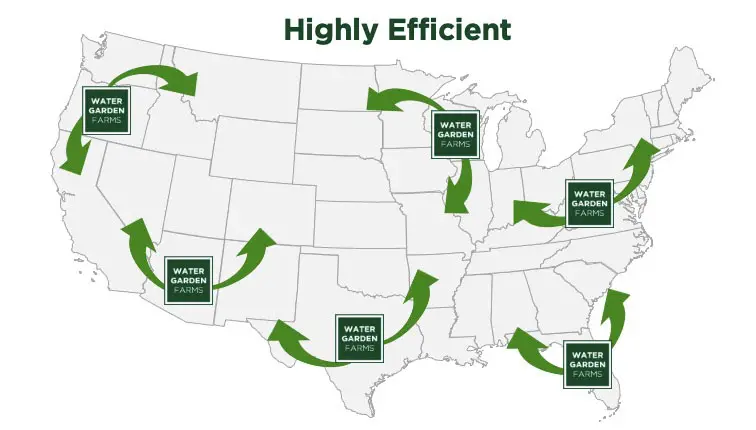

SUMMARYWater Garden Farms (“WGF”) is developing a 540,000 sq. ft., fully automated, AI-driven controlled-environment agriculture (CEA) facility in West Virginia designed to be the lowest-cost, highest-margin leafy-greens producer in the United States. The project integrates proven CEA production with advanced automation, long-term off-take relationships, and FlarePoint’s proprietary 0-net-carbon combined heat & power (CHP) micro-grid, materially improving operating economics and lender bankability.

Target Returns (Equity Investors)

- Target ROI: ~30x multiple over five years (portfolio of six facilities)

- Target IRR: 35–45%+ net IRR to Series B Preferred (conservative, unlevered equity basis)

Capital Raise & Structure

- Series B Preferred Equity: $30 million

- Project-Level Construction Debt: ~$70 million

- Total Project Capitalization: ~$100 million

- Investors receive an 18% equity stake.

Preferred Return & Investor Protections

- 1.0x Return of Capital, plus 10% Preferred Return (cumulative), paid prior to any common equity distributions

- After Preferred Return is satisfied, distributions convert to pro-rata participation.

Conservative Projected EBITDA (Year 1 of Full Production)

Base-Case Operating Metrics (Single WV Facility):

- Revenue: ~$80 million

- EBITDA: ~$50–51 million

- EBITDA Margin: ~65%

- Production Volume:

~39 million 5-oz organic salad units annually

~12.2 million pounds harvested per year - Pricing Assumption:

~$1.95 wholesale price (≈22% below prevailing market), providing strong downside resilience

If you haven’t already joined FlarePoint, now is the time! Only qualified investors can subscribe.

Risk Mitigation Framework

Operational Risk

- AI-driven automation (Siemens) controls climate, nutrients, harvesting, packaging, and logistics

- Horizontal greenhouse design reduces mechanical complexity and downtime

- Fully automated production materially reduces labor, contamination, and yield volatility

Energy & Input Cost Risk

- Electricity historically one of the largest failure points for indoor agriculture

- Eliminated through FlarePoint’s off-grid energy solution (see below)

Market & Revenue Risk

- Existing and historical off-take relationships with national retailers and food distributors

- Local production model shortens supply chain and improves freshness vs. California imports

- Pricing power maintained even at discounted wholesale pricing

ESG & Regulatory Risk

- USDA Organic certification

- No pesticides, no runoff

- ~86% decarbonization vs. open-field farming

- Strong alignment with institutional ESG mandates and green-finance criteria

Owning 18% of the holding company and the first flagship farm gives investors compounding exposure to the platform as it scales across additional states and international markets. The first farm serves as the proven blueprint, allowing future facilities to be replicated efficiently with lower risk and improved financing terms. As new farms are added, enterprise value and cash flow accrue at the holding-company level, enabling early investors to benefit from multi-asset, multi-geography growth and multiple exit paths—turning a single-farm investment into participation in a scalable global food and energy infrastructure platform.